Image credit - tattybadger

Metal Prices To Ease With Softening Demand According To World Bank

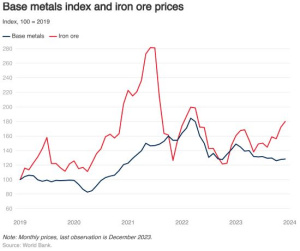

Metal prices according to World Bank’s Metals and Minerals Price Index experienced a slight decrease of 0.13% in 2023Q4 (q/q), continuing steady declines from early 2022. It is attributed to slowing economic activity in major economies, dampened demand amid continued supply recoveries for some base metals.

Source: Jeetendra Khadan and Kaltrina Temaj, World Bank

Metal prices are expected to fall 5% in 2024, after declining nearly 10% in 2023 (y/y). They are projected to stabilise in 2025 (y/y). Key risks to these price predictions include weaker-than-expected demand from China and advanced economies or major disruptions to production. An escalation of the latest conflict in the Middle East could also disrupt trade and therefore prices.

Subdued Global Demand

Metal demand growth slowed to 0.6% in 2023Q3 (q/q) as global manufacturing activity remained subdued. This trend aligns with the global manufacturing Purchasing Managers Index (PMI), which consistently indicated contraction throughout the year.

Monetary tightening in advanced economies weighed on consumer demand for metal-intensive durable goods. Despite a weakened property sector, demand from China’s infrastructure and manufacturing sectors, the energy transition, and optimism regarding policy stimulus to shore up economic activity supported China’s metal demand.

A Modest Recovery In Metals Supply Also Weighed On Prices

Metal output increased in the first three quarters of 2023 (y/y), following production disruptions in 2022. Nickel production grew 15% for the period January to September 2023 (y/y), with increasing supply coming mainly from Indonesia, the world’s largest nickel producer.

Even with production disruptions in Chile in early 2023, which is the world’s largest copper producer, global copper production rose by 7% for the same period in 2023 (y/y). This growth is attributable to capacity expansions in other major producers, including China and the Democratic Republic of Congo.

On the other hand, production growth of energy-intensive metals, such as aluminum and zinc, remain subdued as major European smelters have not fully recovered following closures in 2022 due to high energy costs.

Metal Prices Are Forecast To Fall By 5% In 2024, Before Stabilising In 2025.

The World Bank’s Metal Price Index is expected to fall 5% in 2024. Among various metals, the largest price decline is expected in nickel, followed by aluminum, tin, zinc, lead and copper. Prices are expected to inch up in 2025, with price increases ranging from 2% for lead to 9% for aluminum.

The Price Outlook Is Subject To Several Risks

The primary downside risk to the price forecasts lies in a sharper slowdown in activity among advanced economies and China, which could further weaken metal demand in 2024. Trade restrictions and other policy actions, such as sanctions on Russia and China’s impending aluminum cap, could tighten metals supply and push up prices.

An escalation of ongoing conflict in the Middle East could lead to substantial disruptions in energy markets, increasing production costs for energy-intensive metals. Other short-term risks include environmental concerns, labor disputes, adverse weather conditions, or technical problems can disrupt mining operations and adversely affect the supply of metals in several regions, especially Africa, the Americas, Australia, and Indonesia. In the longer term, an accelerated energy transition would further support prices of some base metals—notably aluminum, copper, nickel, and tin.

What You Missed:

Hyundai Mobis Unveils MOBION Featuring e-Corner System That Enables Sideway Movement

CES 2024 Showcases Latest Innovations In AI, Sustainability And Mobility

Tesla Dethroned By BYD As World’s Best Selling EV Maker

Quang Ninh Industrial Zones Face Electricity Shortage

Siemens And Intel To Collaborate On Advanced Semiconductor Manufacturing

Universal Robots Launches 30 Kg Cobot

Charlie Munger, The Man Who Saw BYD’s Potential Passes At 99

LG Energy Solutions And SK On Lay Off Workers As EV Battery Market Slows

Korea Loses Semiconductor Talent Pool To China

Slaughtering Undone, Sam Altman Resumes Chapter

WANT MORE INSIDER NEWS? SUBSCRIBE TO OUR DIGITAL MAGAZINE NOW!

CONNECT WITH US: LinkedIn, Facebook, Twitter

Letter to the Editor

Do you have an opinion about this story? Do you have some thoughts you’d like to share with our readers? APMEN News would love to hear from you!

Email your letter to the Editorial Team at [email protected]