The move to split GE into three separate units essentially ends the sprawling empire built by Jack Welch and his predecessors(Image Source: GE)

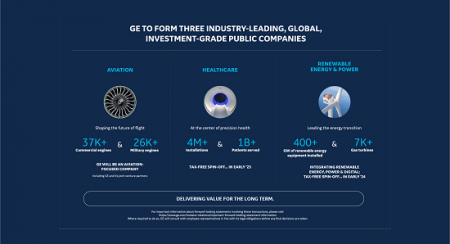

General Electric To Split Into Three Public Companies: Aviation, Healthcare And Energy

Multinational conglomerate General Electric announced recently, it will split into three separate, publicly-traded companies in the latest move by the industrial giant to shore up its fortunes.

GE will spin off its healthcare and energy businesses, and the remaining core of the century-old company founded by Thomas Edison will focus on aviation.

Hard hit by the 2008 financial crisis, the company has undergone several downsizing and restructuring efforts by multiple CEOs, and incurred massive debt.

The Boston-based company said in a statement the split will leave the independently run businesses better positioned to “deliver long-term growth and create value” for customers, investors and employees.

General Electric will spin off GE Healthcare in early 2023, with the parent company expecting to retain a 19.9 per cent stake, the statement said.

It would then combine three divisions – GE Renewable Energy, GE Power and GE Digital – into a single business that will be spun off in early 2024.

This is a defining moment for GE, building on the significant momentum of strengthened financial position and operating performance. They will pursue a tax-free spin-off of GE Healthcare, creating a pure-play company at the center of precision health. Following these transactions, GE will be an aviation-focused company, shaping the future of flight.

As independently run companies, the businesses will be better positioned to deliver long-term growth and create value for customers, investors, and employees, each benefitting from:

- Deeper operational focus, accountability, and agility to meet customer needs;

- Tailored capital allocation decisions in line with distinct strategies and industry-specific dynamics;

- Strategic and financial flexibility to pursue growth opportunities;

- Dedicated boards of directors with deep domain expertise;

- Business- and industry-oriented career opportunities and incentives for employees; and

- Distinct and compelling investment profiles appealing to broader, deeper investor bases.

In today’s portfolio of businesses, GE is on track to reduce debt by more than $75 billion by the end of 2021 and is now on track to bring its net-debt-to-EBITDA* ratio to less than 2.5x in 2023. GE will also continue to drive operating improvements for sustainable profitable growth, and the company now expects to achieve high-single-digit free cash flow margins* in 2023. As a result, GE is in a strong position to execute this plan to form three well-capitalized, investment-grade companies.

GE Chairman and CEO H. Lawrence Culp, Jr. said, “We have a responsibility to move with speed to shape the future of flight, deliver precision health, and lead the energy transition. The momentum we have built puts us in a position of strength to take this exciting next step in GE’s transformation and realize the full potential of each of our businesses.”

References :

1. Press Release_GE

2. RBloomberg

3. Business Times

You might be interested:

E-Mopeds Dominates Philippines’ Micromobility Market

ABB Launches The World’s Fastest Electric Car Charger

The Global Automotive Semiconductor Market

33.BI-MU 2022: International Biennial Machine Tool Exhibition, Taking Place At fieramilano Rho

Oil And Gas Industry Embracing Drones for Remote Inspection

Taiwan’s Two Major Machine Tool Shows To Host Concurrently Next February

How Three Of The Most Carbon Intensive Industries Can Reach Net Zero by 2050

Schneider Electric In Collaboration with AVEVA: Go Green 2022

WANT MORE INSIDER NEWS? SUBSCRIBE TO OUR DIGITAL MAGAZINE NOW!