China Might Just Be ASEAN’s Cash Cow With Outward Direct Investments (ODI)

A research paper by Development Bank Of Singapore (DBS) revealed ASEAN has enjoyed an influx of outward direct investments (ODI) from China. Other data revealed a very telling picture detailing the level of investment interests.

China has consistently held the position of ASEAN’s fifth largest FDI investor, following the US, ASEAN itself, Japan, and the European Union. However, western multinational corporations (MNCs) are crucial in driving investment in ASEAN, as they diversify supply chains and implement the China+1 strategy.

The China Plus One strategy does not necessarily mean companies are moving away from China altogether. Instead, they are diversifying their operations and establishing a presence in additional locations while still maintaining their manufacturing or sourcing activities in China.

Popular destinations for companies implementing the China Plus One strategy include other countries in Southeast Asia, such as Vietnam, Thailand, Malaysia, and Indonesia, which offer lower labour costs and attractive investment incentives. These countries have seen increased FDI as a result of companies seeking to complement their operations in China.

China’s outward direct investment (ODI) into ASEAN recorded a compound annual growth rate (CAGR) of 13.5% between 2013 and 2018, followed by a continued rise of 8.0% between 2018 and 2022. ODI flows into ASEAN reached an impressive US$18.7 billion in 2022, contributing 11% of China’s total ODI.

The Breakdown

Going by geography and industry, Singapore and Indonesia were top destinations for Chinese ODI, with the manufacturing sector dominating. Singapore attracted the highest investment flow of a cumulative US$ 33.9 billion between 2018 and 2022, followed by Indonesia at US$ 15.2 billion during the same period. Strong growth rates were observed across Indonesia, Thailand, and Vietnam, with 10-25% CAGR.

By industry, manufacturing sector drew the largest investment amounting to US$ 33.3 billion over the past five years. Subsequently, wholesale and retail trade received US$ 14.7 billion. Strong growth rates of 10-20% CAGR were observed in manufacturing and electricity and gas sectors. In addition, the information and software sector witnessed a sizeable 50% growth.

Volume of outward FDI flows from China to ASEAN countries in 2022, by sector (in million U.S. dollars)

Source: Statista.com

Data from Statista.com revealed in 2022 alone, China’s outward FDI flows to the manufacturing industry in ASEAN countries reached around US$8.2 billion. DBS’ research added Indonesia remains the primary investment destination, while Malaysia is emerging as a new destination for strong growth.

Notably, Indonesia saw nearly a 400% increase, reaching US$ 5.3 billion in H1 2023. Investment in Malaysia more than doubled, amounting to US$ 1.6 billion in H1 2023. Vietnam also maintained its steady upward trajectory, reaching US$ 530 million.

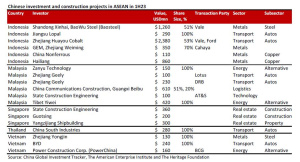

The manufacturing sector remains a hotspot for Chinese investment this year. For instance, Shandong Xinhai and BaoWu committed US$ 1.3 billion to establish a ferronickel processing facility on Sulawesi island in partnership with Vale Indonesia.

Zhejiang Huayou Cobalt invested US$ 2.4 billion in partnership with Ford and Vale Indonesia to supply high-quality nickel for electric vehicle batteries. Meanwhile, automotive giants like Zhejiang Geely and BYD strategically invested in Malaysia and Vietnam to expand their car production bases. In addition, the alternative energy and construction sectors also saw a notable rebound in Chinese investment.

According to the China Going Global Investment Index compiled by Economist Intelligence (EIU), ASEAN has made a significant leap in its ranking this year. Among the 80 major investment destinations, Singapore tops the chart as the most attractive destination for Chinese investors, with Indonesia following closely in the 2nd position, Malaysia in 3rd, Thailand in 5th, and Vietnam in 6th.

Key Sectors Chinese Investors Are Expected To Focus On In The Coming Decade

Electronics

China dominates global production of mobile phones, PCs, and various other consumer electronics products; contributing to 80-90% of the global iPhone assembly. Major manufacturers within the global electronics supply chain are expected to strategically diversify their production facilities after Covid.

This diversification will involve not only the western electronics manufacturers based in China but also the Chinese manufacturers. Among Apple’s top 200 suppliers in 2022, more than 40 were Chinese companies based in mainland China.

On the demand side, the acceleration of digitalisation process after Covid is expected to generate rising demand for various electronics devices and components within ASEAN. This encompasses a continued rise in smartphone penetration rates, establishment of smart factories, planning and construction of smart cities, among others.

Vietnam, with its well-established production network, particularly in the smartphone domain, is expected to remain a preferred investment destination in the electronics sector for Chinese firms. Other ASEAN countries like Malaysia and Thailand, which possess electronics manufacturing capabilities, also hold potential to attract Chinese investment within this sector in the coming years. It is also useful to note Vietnam is now actively doing what it can to qualify as a semiconductor manufacturing hub to support the electronics sector.

Electric Vehicles (EVs)

China currently dominates the downstream global EV supply chain, including a 50-70% share in certain material processing, 70% in EV battery production, and 50% in EV production. The upstream EV supply chain, particularly mining, is dominated by the resources-rich countries like Australia, Indonesia, and Congo.

Indonesia’s embargo on nickel ore exports in recent years has triggered realignments in the EV supply chain. Chinese firms have been compelled to localise their processing facilities for EV metals in Indonesia to secure the supply of nickel resources. It is possible that ASEAN countries may introduce similar protective measures on critical minerals in the future, to further encourage supply chain localisation.

Meanwhile, Chinese EV manufacturers are eyeing the ASEAN market, due to its promising demand prospects. EV adoption in ASEAN remains nascent compared to China, with EV sales constituting 1-10% of new vehicle sales.

ASEAN countries are introducing strategic policy measures to accelerate EV adoption, ranging from tax incentives, subsidies for EV purchases, to the facilitation of EV charging infrastructure. Singapore, Thailand, and the Philippines have set ambitious targets of achieving a 100% EV adoption rate by 2030-2040 — presenting significant opportunities for Chinese EV manufacturers looking to tap overseas markets for expansion.

Renewable Energy

Investment in renewable energy is expected to align closely with the global push for decarbonisation. In response to this imperative, the Chinese government is actively promoting the transition of State-Owned Enterprises (SOE) overseas investment within the BRI framework, moving from the traditional coal and mining activities towards renewables projects.

Meanwhile, the ASEAN region, endowed with abundant natural resources including wind, hydro, and solar power, holds substantial technical potential for renewable energy expansion. The majority of ASEAN countries are aiming to achieve a 30-40% share of renewables in their power generation mix by 2030-2035. This underscores substantial demand for renewables investment in the years ahead.

Technology, Media And Telecommunication (TMT) Services

Investment in TMT services will be influenced in part by policy and regulatory changes. Chinese internet, fintech and other private enterprises in the TMT services sector are facing challenges due to the complex regulatory environment in China’s domestic market, and stricter investment scrutiny in the US. As a result, they are exploring opportunities in the ASEAN market more extensively.

In the manufacturing sector where Internet Of Things (IoT) gets increasingly common, downtime and enhanced efficiency have become imperative staples to beat competition. That is also where the industry witnesses many players offering solutions such as easy accessibility and servicing 24/7 for machine shops, evangelising the importance of predictive maintenance.

According to a collaborative report by Google, Temasek, and Bain & Company, Southeast Asia’s digital economy will surge from US$ 200 billion in 2022 to US$ 600 billion -1 trillion by 2030. Emerging markets like Indonesia and Vietnam are poised for substantial growth in this sector. Singapore, with its role as a regional investment and financing hub in the TMT startup domain, stands to benefit as well.

China’s ODI underscores ASEAN’s growing appeal, with the republic consistently ranking as ASEAN’s fifth largest FDI investor. While western multinational corporations play a pivotal role in driving investment, the China Plus One strategy has emerged as a nuanced approach.

Rather than a complete shift away from China, companies are strategically diversifying their operations. Southeast Asian countries like Vietnam, Thailand, Malaysia, and Indonesia have become favoured destinations with lower labour costs and attractive incentives. The sustained growth in China’s ODI into ASEAN, with a notable 11% contribution to China’s total ODI in 2022, signifies the enduring partnership and the evolving dynamics of economic collaboration between these two influential regions.

Related Stories:

Supply Chain Shifts Fuel Foreign Investments Into ASEAN

Rise Of The Machine In Shop Floor: Don’t Panic Just Yet

Edmund Boland Appointed As GM Of ANCA CNC Machines

Ningbo Rail Transit Selects SKF Technology For Bearing Life Extension Project

Metal Cutting Helps Researchers Understand Metals’ Behaviour Under Extreme Conditions

ISCAR’s Shrink Upgrade: Empowering Precision with Advanced Tool Holding

Tesla Leverages Malaysia Tariff Liftings For A Later Grand Entrance

A*STAR Leads R&D Programme With 10 Industry Partners To Develop High-Performance EV Components

HP To Shift PC Production To Thailand To Reduce China Reliance

OpenAI Sued For Copyright Infringement

WANT MORE INSIDER NEWS? SUBSCRIBE TO OUR DIGITAL MAGAZINE NOW!

CONNECT WITH US: LinkedIn, Facebook, Twitter

Letter to the Editor

Do you have an opinion about this story? Do you have some thoughts you’d like to share with our readers? APMEN News would love to hear from you!

Email your letter to the Editorial Team at [email protected]