It can be a massive challenge to resume normalcy post pandemic. However, it need not spell continual declined efficiency if the right strategies are in place to optimise your machine shop.

Wistron – iPhone Maker To Wind Up Operations In India

Wistron iPhone manufacturing facilities in Karnataka will be taken over by Tata Electronics

Sandvik Coromant Demonstrates How To Obtain More Haste With Less Waste

Sandvik Coromant product manager, Rolf Olofsson, explains a different approach to steel turning (waste producing process) — how manufacturers can improve their sustainability without compromising process security.

How To Keep Your Best Talent In The Machine Shop

A refreshing piece in a metal fabricating site stressed the importance of leaders’ role and how they shape the success of the machine shop.

TSMC Vs Intel: Blue-Chip Semiconductor Giant Is The Better Turnaround Play?

TSMC and Intel (INTC) are bellwethers of the semiconductor market. TSMC is the world’s largest contract chipmaker, while Intel is the leading manufacturer of CPUs for PCs and servers.

IoT In Manufacturing: How Are Factories Streamlining Services?

The manufacturing industry is also enjoying the flavour of disruption through the applications of IoT.

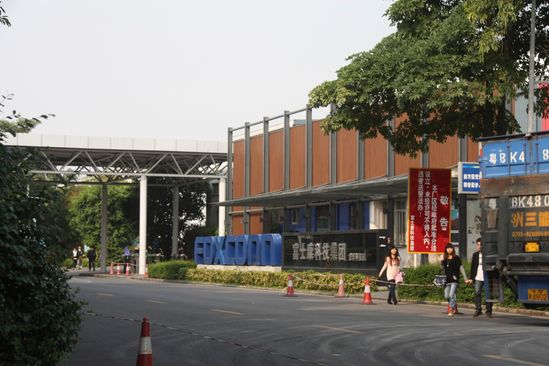

Indonesia Says Foxconn May Invest In Projects For New Capital

Indonesia said Foxconn Technology Group is considering investing in the country’s new capital, a move that would bolster the US$34 billion (S$47 billion) construction project.

Why Metrology Matters In The Digital Era

Digital technologies such as artificial intelligence, big data, and machine learning are increasingly important to the manufacturing industry. Just imagine the implications for metrology—the science of measurement.

Internet of Things Asia 2022 Returns After Two Years

Digital edition places urgency on adopting IoT solutions in a post-pandemic era

The Megatrends That Push Manufacturers Towards Industry 4.0

Disruptive technologies and megatrends are shaping the future of manufacturing. The fourth industrial revolution has been gathering momentum in recent years and is set to be transformative for Southeast Asian manufacturers. Industry 4.0 refers to the digitisation of the manufacturing industry, and a realisation of the potential of the Internet of Things (IoT), combined with artificial intelligence and data science. Done right, Industry 4.0 will enable manufacturers to improve efficiencies whilst reducing costs. By Vincent Tang, Regional Vice President, North Asia, Epicor.

THE industrial revolution is far from surprising. By 2020, there will be 30 billion connected devices on earth. This will lead to the creation of a big data mountain that would have grown beyond recognition. Machines communicating with people as well as with other machines are creating so much data that we have generated more data in the past two years than in the previous 5,000 years of human history.

It is now up to manufacturers to unlock the potential of this data. The information generated by the increase numbers of connected devices and machines represents a significant opportunity. By determining how to best identify, capture and interpret this increased volume of data, it can help organisations understand their market and customers better, as well as gain market share.

Southeast Asia alone accounts for five percent of global manufacturing activity, and with deeper regional economic integration brought about by the establishment of the ASEAN Economic Community, it is poised to become a more competitive industrial centre. Two fifths (40 percent) of the industrial companies in Southeast Asia have already rated their level of digitisation as high, and this value is expected to rise to 69 percent within the next five years.

Manufacturers in Southeast Asia have an opportunity to leapfrog ahead of those in developed economies because they have fewer legacy issues such as outdated systems, processes, and technological capabilities that need to be addressed.

In today’s fast moving global markets, Southeast Asian manufacturers need to respond quickly to changing demands and maximise new market opportunities. From all indications, we are in an era of significant convergence, where information technology, operational technology, and global megatrends are on a collision course. This will drive changes in how we do business and how we interact with customers and suppliers.

Megatrend #1—Demographic Shifts

We are witnessing population growth in some nations and shrinkage in others as well as a growing middle class, consumer markets shifting from the west to the east and an ageing population with fewer people entering the manufacturing field. Take heart though as the technology we are developing continues to make it easier to collaborate and is helping to attract the discerning millennial generation, which is anticipated to account for 75 per cent of the global workforce in 2025, and will play an important role in manufacturing as it continues to evolve.

Megatrend #2—The Globalisation Of Future Markets

Companies will expand their operations globally, with worldwide exports expected to triple by 2030. Exports from emerging and developing countries will quadruple, and regional and bilateral trade agreements are likely to further open the world’s borders. The share of GDP generated by the BRIC (Brazil, Russia, India, and China) countries will grow. Sub-cluster countries comprising Mexico, Indonesia, Nigeria and Turkey (MINT) and Mexico, Indonesia, South Korea, Turkey (MIST) are in a position to outperform the advanced world. Technology will continue to be a big enabler of globalisation. Not only through eCommerce and the opening up of additional markets, but also with regards to having enterprise resource planning (ERP) systems in place to support cross-border trading and multi-country manufacturing processes.

Megatrend #3—Scarce Resources

Due to increased energy use and requirements, we’re going to need more power. Resources are growing scarcer despite the focus on climate change and sustainability, and there will be continued reliance on fossil fuels. The majority of critical raw materials will be likely supplied by China by 2030, and certainly by countries outside the US and Europe. This could potentially be mitigated by innovative recycling technologies, and using technology platforms to streamline processes and improve efficiency so as to facilitate this shift.

Megatrend #4—Knowledge And Gender Gap

Manufacturers will feel the challenges incurred by a decreasing talent pool. As there may not be enough skilled people to perform the jobs of the future. The available pool of workers will likely come from developing countries as we see greater percentages of the population earning post-secondary degrees than their more developed counterparts. An ever increasing mobile workforce will continue to present challenges to employers and may lead to a global struggle for talent. Their wants and needs are very different to those of the generation before. Attracting millennials requires enhanced mobility, technology that meets their expectations with a sophisticated user experience and having more flexible working patterns than ever before.

Industry 4.0, ERP And The Transition Ahead

These four global megatrends, when combined with new and converging technologies, will require manufacturers to transform themselves. We are quickly entering an era of a new type of customer, a global customer who could be based anywhere in the world rather than in the countries that manufacturers have traditionally traded with. This new customer is more mobile, more aware, and more demanding.

In addition to the changing demographic of customers, new game-changing business models will cause continued disruption. Just take a look at what Uber has done to the taxi industry, Airbnb to the hotel industry, and Amazon to the retail sector. The frantic pace of change in every industry demands business owners to adopt new ways of thinking and execution.

There is a tremendous opportunity for manufacturers. However, it can only be realised by using emerging information technologies like social, mobile, analytics, and cloud alongside operational technologies like sensors, machine-to-machine communication, additive manufacturing, and robotics.

Industry 4.0 challenges the way that manufacturing, which is at its very core a risk averse sector, functions with centralised and offline systems that are not interconnected. We would further predict that their factories will soon evolve to become ‘smart’ with the capability to self-manage issues and internal processes.

Crucially, manufacturers need to address whether their existing ERP environment is ready to support their journey towards Industry 4.0.

For manufacturers, growth in an Industry 4.0 environment will be intrinsically linked with a business’s ERP system. Certainly, the boundaries between production and management must disappear, and ERP and manufacturing execution systems (MES) must form an integrated unit if businesses are to realise the growth opportunities presented by this new age of intelligent manufacturing. Taking a critical look at the existing IT environment in your business is the first step towards understanding how ready or unprepared you are for Industry 4.0.

- 1

- 2